Table of Contents

Long Call Option Strategy involves buying call option of any selected strike price. With the help of this this strategy you can take leveraged long position in the market without paying any margin. You have to pay the premium price only.

When to deploy long call strategy?

Long call strategy can generate profits if sudden up move comes in market. Remember time is very crucial in deploying this strategy because you will lose your complete premium amount if option expires OTM (out of the money).

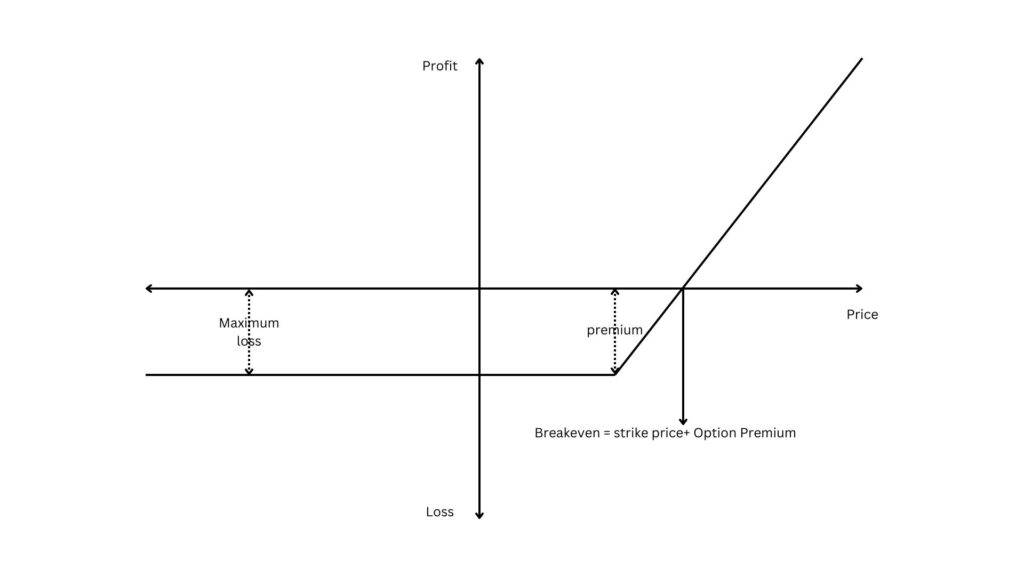

Break even point

Stike price + option premium

Maximum possible loss

Option premium paid

Maximum possible profit

Long call option strategy has possibility of unlimited gain. However, unlimited possibility of gain is theoretical as average change in price is less than 1% in case indices like Nifty, Bank Nifty etc.

Illustration

Suppose Nifty index is trading at 22500 level. There are three scenarios in long call strategy.

Buying In the Money call option

Suppose you buy 22200 CE three days before expiry. Option premium for such call option will be higher as it will have intrinsic value.

Option premium = intrinsic value + intrinsic value

Advantages of in the money long call option strategy

- Higher delta: Due to higher delta you can capture more points in the premium e.g. if nifty moves 100 point up you can capture close to 100 points in the option premium (as delta id between 0.5 to 1).

- Lesser theta decay: Since option premium of in the money call option has intrinsic value component so percentage drop in option premium due to theta decay will be lesser.

Disadvantages of in the money long call option strategy

- Higher premium requirement because of intrinsic value in option premium

- Incase of sharp up move low return on investment (but it is highly unlikely)

Buying At the Money call option

suppose you buy 22500 CE three days before expiry. Option premium for such call option will have only time value and no intrinsic value. This is the most suitable spot for long call strategy.

Advantages of at the money long call option strategy

- High rate of return: As delta is 0.5 and premium price don’t have intrinsic value.

- If market goes up delta also rises for 0.5 towards 1 thus increase in premium price will be faster.

Disadvantages of at the money long call option strategy

- Faster theta decay compared to in the money long call option.

- You will end up losing 100% of premium if price doesn’t go up.

Buying out of the Money call option

Suppose you buy 22800 CE three days before expiry. Option premium for such call option will be very low but the chances of profit are only when there is sharp price move.

Advantages of out of the money long call option strategy

- Very low premium.

- Very high rate of return in case of sharp up moves. Option premium price may even double or triple.

Disadvantages of out of the money long call option strategy

- Very fast theta decay

- Very risky trades as most of the time out of the money options premium decays to zero.

Impact of volatility in long call strategy

Option premium price has a component of volatility called Vega. Option premium tends to rise whenever there is a rise in volatility and vice versa.

Long call strategy pay out graph.

FAQs

You can deploy long call strategy when you expect a sudden price rise or a price breakout. It is advisable to go with this strategy with a momentum indicator like RSI or Super trend and hold the trade till momentum exists and exit as soon as possible to avoid theta decay.

Long call strategy doesn’t have inherent risk reward ratio rater it depends on stop-loss and target of the trade.

This strategy does not require margin money. You only need to pay premium amount.

depends on stop-loss and target of the trade.